In the unfortunate event of your death, it’s important to know what will happen to your RPS pension benefits when you die.

Whilst you are paying into the RPS, you get life cover to help take care of your loved ones once you’re gone.

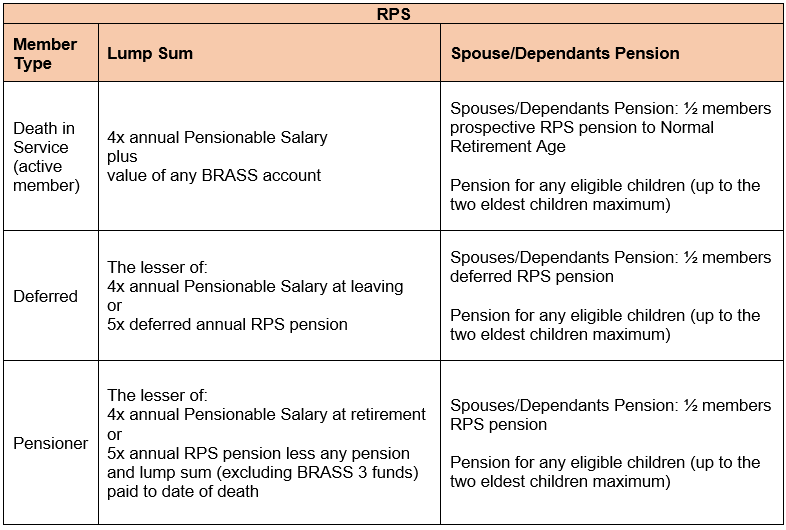

A lump sum equal to four times your annual Pensionable Salary is payable, plus the value of any BRASS account, as well as a Spouses/Dependants pension for life. There is also pension provision from any eligible children.

If you are no longer paying in to the RPS but you have retained your RPS benefits in the Scheme, a lump sum is payable equal to the lesser of four times your annual Pensionable Salary at leaving or five times your deferred annual RPS pension. A Spouses/Dependants pension for life is also payable, as well as a pension for any eligible children.

What if I’ve already retired?

If you have already claimed your RPS pension benefits and you die in retirement, a lump sum is payable equal to the lesser of four times your annual Pensionable Salary at retirement or five times your annual RPS pension less any pension and lump sum (excluding BRASS 3 funds) paid up to the date of death. A Spouses/Dependants pension for life is also payable, as well as a pension for any eligible children.

If you leave a Dependant, they will be paid a pension for life equal to one half of the RPS pension payable at your date of death, before any reduction to your pension if you took a cash lump sum at retirement.

The RPS pension payable may be reduced if your Dependant is more than ten years younger than you.

A summary of the above can be found below:

Children’s pensions

An eligible child is under age 18, or if they are in full-time education, under age 23.

If there are more than two children, the two eldest eligible children will receive children’s pensions.

Nomination Form

It is really important that you tell us who you would like the Trustee to pay any lump sum death benefits to in the event of your death.

You can update your Nomination Form electronically in your online RPS Member Account.